Teaching Financial Literacy to Secondary Special Education Students

An important part of teaching independent living skills is to include financial literacy in special education lesson planning. Activities related to budgeting, managing finances, and investing are necessary to thoroughly address financial literacy for teens. Then, when asked what is financial literacy, students with disabilities can answer clearly the skills they have for this area of life!

However, there are challenges in teaching students with disabilities how to understand and manage their finances. Individualized instruction and accommodations in teaching financial literacy are two foundational elements along with support that will lead students with disabilities to success. Keep reading for a variety of strategies for teaching financial literacy to this unique group of students.

What is Financial Literacy?

Financial literacy incorporates vocabulary and skills to better understand all things related to finances.

Topics range from more straightforward ones such as understanding money values and recognizing different denominations to more complex skills such as navigating different financial institutions, reading a paycheque, paying for things on credit, and understanding interest rates.

There is a lot to know about financial literacy but using the approach of slow and steady wins the race can lead to success!

Adapt Financial Concepts for Special Education

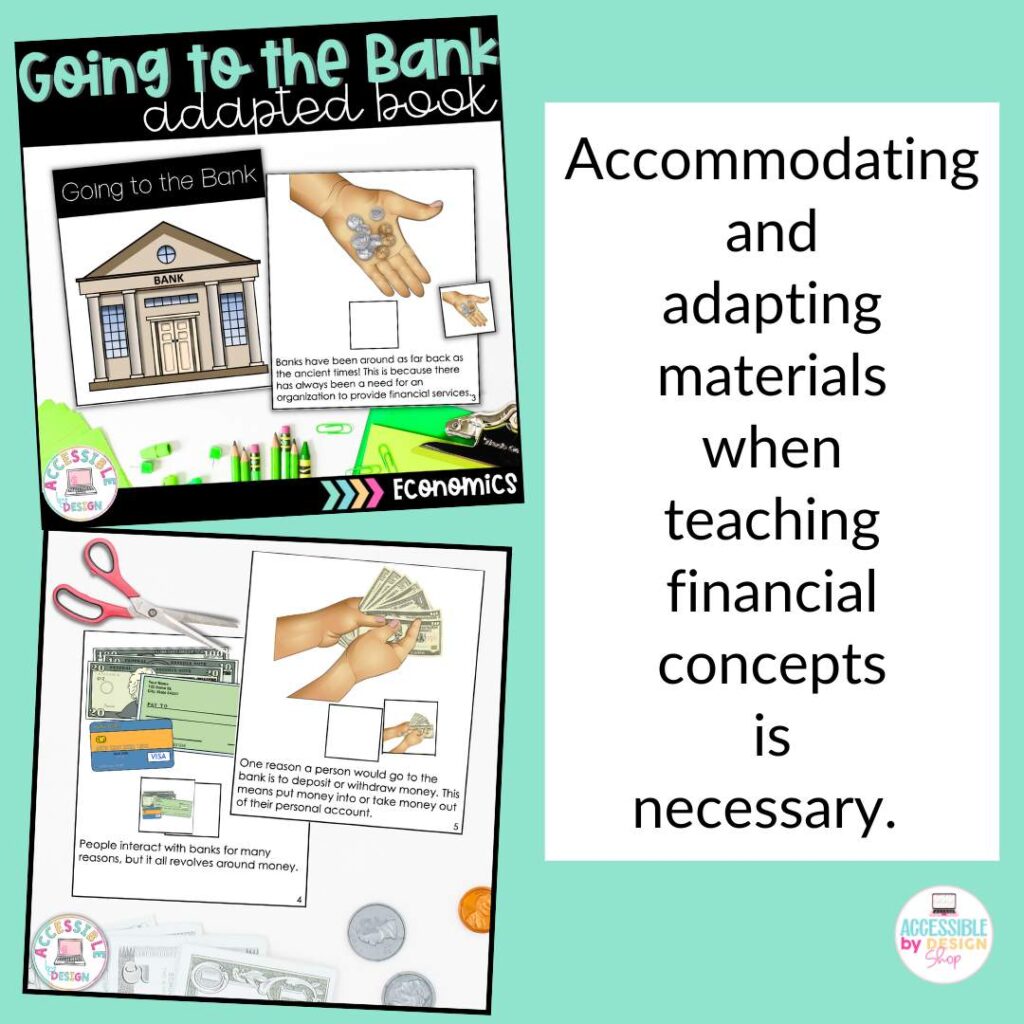

Like most lessons in special education, accommodating and adapting materials when teaching financial concepts is necessary.

Wherever possible, simplify complex financial terminology and concepts into more accessible language. For example, students don’t need to know everything the IRS does, but they do need to understand that it’s a government agency that focuses on managing taxes (then you’ll have to explain what taxes are – in this case start with a lesson about earning money, like in this teacher freebie!).

Using visual aids, such as charts, diagrams, and images will enhance understanding. Adapted books are a great option to use in special education classrooms. Check out this one focused on going to the bank. It includes 10 pages in digital format that introduces what banks are, why people go to banks, and ways to bank.

Build Basic Financial Skills

The saying slow and steady wins the race is apt but only when accompanied by a strong foundation. In this instance, start with basic financial skills such as identifying and counting money and build from there.

Bring the world of U.S. currency to life for your students with an interactive book designed to capture your students’ attention and encourage active participation with clear visuals and simplified language. This interactive digital reader can do just that while covering everything from the $1 bill to the $100 bill. While this book covers pennies, nickels, dimes, and quarters. Each resource highlights important details such as symbols, numbers, and faces that will solidify students’ understanding of denominations.

Once students have an understanding of the different denominations, incorporate lessons to practice adding money. This resource includes 30 days of math with 30 printable worksheets featuring real-world math problems designed with special education teachers in mind!

The next step is then to introduce the basics of budgeting skills. This includes setting financial goals, distinguishing between needs and wants, and creating spending plans.

Finally, foster an understanding of saving and banking by covering topics such as opening a bank account, depositing money, and the concept of interest.

Include Real-World Experiences

Experiential learning and activities with ties to real-life situations always encourage students to be more engaged. In seeing the practicality of such activities, students generally buy into such lessons so why not include them where and when you can?

Begin with opportunities for students to practice their financial skills in real-life situations within the classroom, such as creating mock budgets or participating in simulated financial scenarios. You could use an activity where students practice reading price charts related to common community events.

When possible, explore the community and its resources and programs that can support students in their financial education. It might be a trip outside of the classroom by partnering with local banks or credit unions or inviting an expert to deliver a financial literacy workshop in class.

Collaborate with Parents and Caregivers

When it comes to financial literacy, it’s always great to incorporate parents and caregivers in order to reinforce financial literacy skills at home. Encourage open communication between teachers, parents, and caregivers to ensure consistent support and reinforcement

Now, rather than leaving students’ caring adults to create options, share tips and resources for parents to continue the financial education process beyond the classroom. For example, what does the weekly grocery shopping plan look like before and after? What list might be created by keeping the budget in mind? This might mean reviewing printed or digital flyers for different grocery stores. Then finally, review the final receipt for purchases, individual and total costs, as well as taxes and payment options.

Final Takeaways about financial literacy

Teaching financial literacy to secondary special education students is important for their future independence and well-being. Like most important skills, ongoing reinforcement and application of financial skills will promote long-term understanding and success. As a result, it is an area of learning that educators and all stakeholders should prioritize for all students, including students with disabilities.

2 Comments

Comments are closed.